understanding UK benefits

Our in depth UK benefits list explores the different types of benefits and who's eligible to receive them.

View moreWant to know how to spot a scam? See helpful advice on how to avoid scams – online, on the phone, and via phishing. Check out our easy guide.

Are you unsure how to keep your personal or financial information safe from scammers? Want to know how to tell if someone is scamming you? Knowing what to look for and what steps to take if you suspect a scam can help save you from some potentially devastating consequences.

If you’re unsure what to look out for or what to do if you think something could be a potential scam, our useful acronym will help you identify a possible scam.

The golden rule of avoiding scams is to be vigilant. So, you should know what kind of scams to look out for. These are the most common forms of scams:

If you find yourself in a situation where you think someone might be trying to access your financial information or something seems too good to be true, our helpful acronym can help you identify any potential scams and remember what to do if you’re unsure.

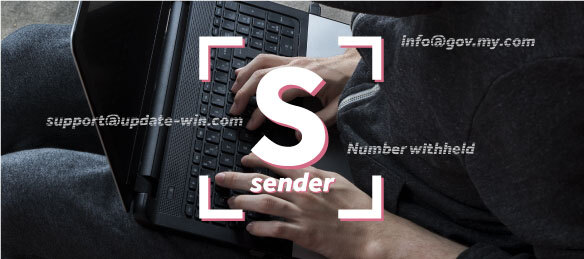

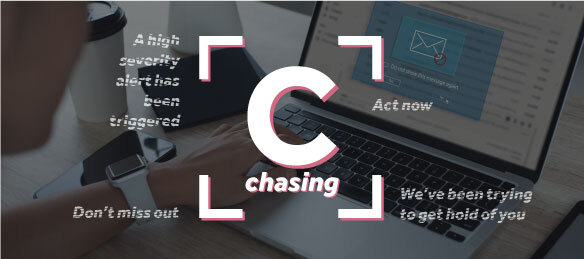

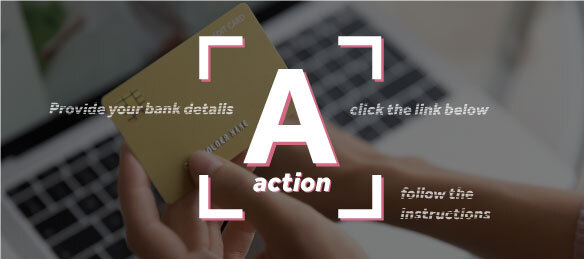

By thinking S.C.A.M, you can carry out a quick checklist to help you work out if a request for financial or personal information is genuine or not. If you're asking yourself 'what are the red flags of a scammer?', these are the top signs:

Knowing what to look out for and feeling confident to check or challenge what you're being asked to do, especially where something doesn't feel quite right, is very important. If you’re still unsure or worried that you might have been scammed, reach out for support.

It’s important to remember that anyone can be a victim of a scam. If you’re worried that you've been scammed online or through another method, or your financial security has been compromised, or you spot any fraudulent activity on your bank account, it’s important that you reach out to your bank directly and immediately.

Report what’s happened, and your bank can act like blocking or freezing your bank account or credit card so no money can be taken from it.

We help the ICAEW community thrive through everyday situations to exceptional life-changing circumstances.

Falling victim to a scam is nothing to be embarrassed about. If you have concerns about your personal finances, our team are here to help, and all our services are free and strictly confidential.

Our in depth UK benefits list explores the different types of benefits and who's eligible to receive them.

View more

Stress can creep up on us when we least expect it and leave a lasting impact. Use our advice to help notice stress and what you can do when it appears.

View more

Anxiety and depression can affect anyone in every walk of life. Here at caba, we're here to help whenever you need us.

View moreWe support past and present members of the Institute of Chartered Accountants of England and Wales (ICAEW), ACA students, ICAEW staff members, and the family and carers of members and students.

Not sure if you’re eligible? Use our interactive eligibility tool to check if you or your family could get support.

Most of our services, including mental health support and legal advice, are provided free regardless of your financial circumstances. For our financial grants, we will conduct an assessment, looking at your income and assets, to determine what help we can provide.