50-30-20 calculator

This 50-30-20 calculator splits your take-home monthly income into suggested spending in three areas: necessities, wants and savings.

Whether it’s the everyday or out the blue changes to your situation, balancing our finances is challenging. Our financial support and grants are here to give you safety net to help get you back on your feet.

When logic and planning are second-nature, things that you can’t predict – like the UK bill increases – can leave even the most financially savvy feeling frustrated, worried or overwhelmed.

Sometimes, a small helping hand is all you need to get back in control and stop any downward spirals. Our financial support means you can breath a sigh of relief. With the pressure lifted, you can get back to what matters to you.

All our grants and donations are short term or one-off payments to help cover bills and unexpected costs. You don’t have to pay the money back.

Our support is means-tested. Talk to us before you assume you won’t be able to get financial support – we can help more than you might think.

We know that life has ups and downs – but it’s not the ups that keep awake at night. It’s our mission to take the edge off. If UK bill increases and money worries are weighing on you, we’re here to help lighten the load. Here’s the support you can start applying for today.

Keeping your home at a reasonable temperature is good for your health and your wellbeing but as energy costs are rising, you might find it too expensive to heat or cool your home. Our energy costs payment is a fixed sum of £500 to help pay your gas, oil, electric and other energy bills. This is on top of any other payment from the government. If you’re living outside the UK, it can also be used towards air conditioning, batteries and generators.

Getting your children ready for a new school year can be expensive. Our back-to-school discretionary donation is a fixed sum to help cover these costs. The money can be used to buy school uniform, shoes, PE kits and other school essentials. Applications are open from May-October.

We know that keeping your ICAEW membership is really important for both personal and professional reasons, but it might be challenging to pay it even at a reduced rate. We can provide a donation to cover this cost, and can pay it directly to the ICAEW for you.

We also offer a range of financial support for students, making sure you’re supported right from the start of your career journey.

As we head into a substantial bill increase across many of our utilities, we sat down with Mel, our benefits advisor, to find out what you can do if you're struggling or worried about affording essential bills.

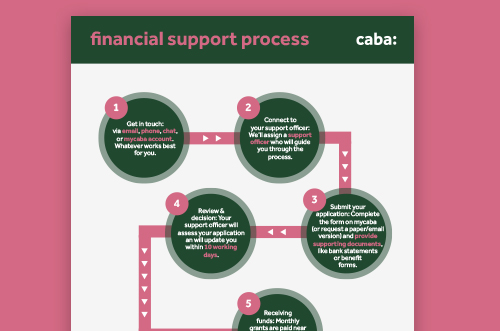

Wondering how our financial support process works? We’re here to make it as easy as possible. Take a look at our step-by-step breakdown and get the help you need, minus the hassle.

Explore our range of financial tools that can help put your money worries at ease.

This 50-30-20 calculator splits your take-home monthly income into suggested spending in three areas: necessities, wants and savings.

Want to know what grants you are eligible for? Try our free grants search tool to discover what money you might be missing out on that you won’t ever have to pay back.

This benefits calculator is supplied by Turn2us, a free, independent service which helps people access the money available to them – through welfare benefits, grants and other help.

MoneyHelper’s budget calculator alongside our downloadable budgeting spreadsheet can help to show you exactly where your money is being spent and how much you’ve got coming in.

One thing about saving is that, sometimes, it can be difficult to know how much to save or how long it’ll take. Try out MoneyHelper’s savings calculator below to tackle both those problems.

The UK is seeing a bill increase in 2025, with increases to water bills, average energy bills, stamp duty and car tax, to name a few. Regardless of your financial situation, unexpected bill increases can always put pressure on your budget, making it harder to stay in control. To help ensure a stable financial future, we’ve broken down what the UK bill increases look like. Remember, at caba, we offer means-tested financial support and grants that can help you manage some of the increases.

The annual energy bill for a household using a typical amount of gas and electricity will go up £111 a year to £1,849 from April. If you are worried, get in touch with caba - we might be able to help with financial support.

Water bills for households are due to go up in England and Wales by £10 more per month on average, depending on supplier. Southern Water is seeing the highest increase at 47%, while the likes of Anglian and Severn Trent see increases at around the 20% mark. Refer to your water supplier for more information.

In England, local authorities with responsibility for delivering social care can increase council tax every year by up to 4.99%. Check with your local council for council tax exemptions, or get in touch with caba if you are struggling financially.

The standard rate for most cars will rise in line with inflation, while EVs will no longer be exempt from road tax. Compare insurance providers, or see if switching to a low-emission car could reduce your tax rate.

The government is reducing the stamp duty threshold, resulting in buyers paying duty on property purchases. If you're buying a house soon, check if you can complete before the threshold changes.

Several indirect tax increases, such as higher alcohol duties and frozen income tax thresholds, mean you could be paying more tax without realising. Review your finances and and reach out to caba if you need assistance.

Some providers will be implementing a fixed £3-3.50 monthly increase, while others will be using a fixed percentage at the rate of inflation. Check with your provider for more information, and make the most of comparison websites to get the best deal.

If you signed a contract before April 2024, you will likely see an increase on your phone bill, which will rise at the rate of inflation. Compare deals and, if your contact is ending, negotiate with your provider for a better deal.

TV licenses will rise to £174.50, a total increase of £5. This will affect anyone who signed a contract prior to April 2024.

Take back control of your personal finances by talking through your situation with one of our friendly support officers. We're here to help you with anything you may be going through, offering guidance, practical solutions, and a listening ear.

“It was difficult to admit that I needed some help, but it gets easier every time. caba are very easy to get on with and nothing seems to take very long. I feel more secure now.”

Amelia

caba client